If there’s one thing this decade has taught us so far, it’s that everything changes all the time. And that definitely includes the ‘rules’ of tech fundraising, which just get more unpredictable as the years go by. After a bumper year of capital raised in 2021, investment nosedived significantly. It has bounced back this year, but experts agree the landscape is very different now and founders hoping to raise funding would be wise to take notice.

If you’re planning to fundraise in Ireland in the second half of 2025, you’re entering a market that has changed in fundamental and systemic ways. Not temporarily. Not due to sentiment. You’re operating in a new normal.

SaaS is dead, long live SaaS

When generative AI burst onto the scene at the end of 2022, it seemingly obliterated the barrier to entry for coding (even more than the low code/no code platforms). Suddenly non-technical users could produce functional code and technical prototypes quickly. There was a surge in ‘citizen developers’ building small apps and automations, while faster prototyping cycles led to greater experimentation in startups and SMEs.

Agentic AI gained noticeable traction in early-to-mid 2024. Now you could have autonomous systems capable of planning, executing, and adapting tasks with minimal human intervention. Think workflow automation, customer service, data analysis, and research assistance; integration into business platforms to handle multi-step processes; and experiments in autonomous decision-making for operations.

Many people started to declare that this was probably the end of SaaS. Why pay big fees for one-size-fits-all systems lacking the nuance to reflect a company’s specific processes, culture, or evolving needs. Instead, the argument went that now everyone can build, customise, and run tailored workflows on demand, blurring the line between software as a service and autonomous service provision.

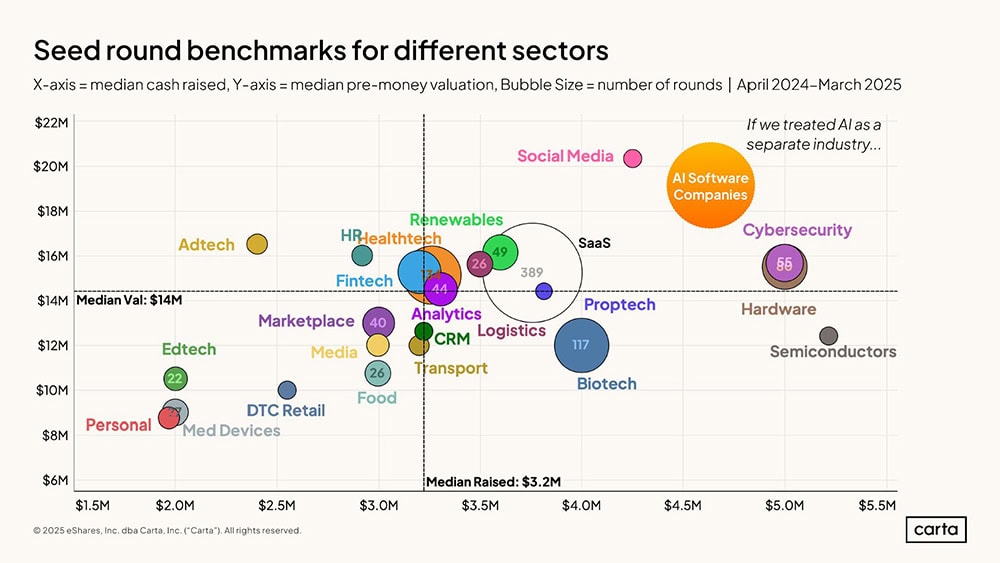

It might be surprising then to see that SaaS is not, in fact, dying. It’s experiencing robust growth in 2025, and Gartner reports that global SaaS spending is projected to reach approximately $300 billion this year. Seed and Series A valuations are currently high, but a lot of this is down, again, to AI. Data from Carta shows that valuations have been higher for AI SaaS companies since 2022. AI integration, vertical solutions, and enterprise adoption are the name of the game now.

Personally, I expected the revolution in coding to mean that companies would start building their own bespoke software, but I just don’t see this happening. Every platform now claims to be powered by AI, but are the AI features the reason people are buying or is it the core functionality that they find most useful? Buyers are overwhelmed with sales calls for new SaaS products and are simply not interested in trying something new; instead, it seems that the big SaaS companies with market share will continue to consolidate. As these incumbents get bigger and stronger, it will be harder to compete with them.

The SaaS funding trends to watch out for

If you are growing a SaaS product and looking towards fundraising, what should you bear in mind? While the topic is vast and there is no substitute for working closely with an experienced advisor, here are a few things to consider.

More careful client spending

Budgets are under tighter scrutiny, and many SaaS companies like Salesforce, HubSpot, and Asana acknowledge rising challenges in customer retention and deal-making. Much of the new AI-related spend often comes from reallocating existing budgets rather than pure growth. Despite these pressures, AI-driven demand is accelerating overall SaaS investment, helping to offset tightening conditions and driving new use cases.

Proven, real-world value

Irish buyers, particularly mid-market and enterprise, are becoming increasingly sceptical of per-seat pricing. Procurement teams are looking for pricing that aligns with value delivered, not just usage. If you can build pricing around outcomes (like time saved, revenue generated, or compliance achieved) you’ll unlock more budget and faster closes.

Expect slower growth

Although it does look like some SaaS platforms are doing really well, growth is slower that we’re used to. With a flattening total addressable market (TAM) in many categories, every sales conversation takes longer, costs more, and closes less often. It used to be that a startup would go for a new funding round every 18 months. Not anymore. Data from Carta shows the time between raises is stretching out, with it now taking over two years from seed to Series A, and at least two and a half years between a Series A and B or Series B and C.

Platform thinking beats point solutions

A tool that does one thing really well and then can’t scale is a movie that investors have seen before. In 2025 and beyond, founders raising in Ireland will need to show how they fit into a broader ecosystem. Are you building a platform? Can you integrate into existing workflows? Can you be the foundation of a stack rather than just another app within it?

Execution earns trust

Venture capitalists in Ireland – and across Europe – have shifted their focus. The days of ‘grow fast, fix later’ are gone. VCs are looking for a clear path to sustainable growth, ideally underpinned by defensible differentiation and a credible go to market (GTM) strategy that doesn’t rely on burning €1 million a quarter to acquire revenue. The bar has been raised. Not impossibly high, but certainly higher than most first-time founders realise. It’s not about your ideas but about how you operate. Read more in our recent blog about raising funding from angels and VCs.

Teams are shrinking

Another trend is team sizes. Not only are shareholding team sizes shrinking, but founders are increasingly delaying the time to making their first, second, or third hires (Carta data again). Hiring in general has been trending down since 2022. According to Growth Unhinged, the median $1 million to $5 million ARR SaaS startup has only 25 full-time employees, down materially from 34 in 2023 and from 46 in 2022.

The state of play for a SaaS startup in Ireland

The latest Venture Pulse survey conducted by the Irish Venture Capital Association (IVCA) and William Fry found that VC investments into Irish SMEs reached a year-on-year increase of more than 100%. Venture capital firms invested €532.8 million in Irish SMEs in Q1 of this year, marking a record for funding in a single quarter. You can see more about recent tech funding successes in our blog from earlier this year.

But success is not guaranteed, as much of this came from a handful of mega-deals. EY acknowledges the persistent funding gap we’ve already explored for startups seeking €1 million to €10 million (deals under €5 million declined in both volume and value during 2024) and the government is now working harder to strengthen the support. Currently these startups are just too advanced for early-stage supports but not big enough to attract global investors.

VCs, especially those deploying capital in Ireland, are wary of anything that smells like another undifferentiated tool. They’re scanning for true vertical expertise, real communities, and efficient paths to revenue. You need to own a niche and go deep. Irish SaaS companies with strong vertical focus – legaltech, agritech, compliance, and fintech infrastructure – are still raising, because they’re not trying to compete in the bloated generalist categories.

I’ve discussed before about just how hard it is to scale a company to a unicorn valuation, and we used Xero as an example. Despite having a product that was 10 times better than the incumbents Sage and QuickBooks, it took Xero an investment of $100 million and 10 years of laser focus to crack the UK market, where they now have 1 million users. Learn more about this in our blog about scaling tech startups.

Two fundamental funding questions to ask

The Irish SaaS ecosystem is maturing. There’s still money on the table, but it’s harder to earn. Smart founders are also exploring grants, angel investors, and crowdfunding to build a more resilient financial foundation. It’s not about flash pitch decks or lofty projections anymore. It’s about building something real, with real discipline, for a real market.

If you’re thinking about fundraising soon, ask yourself two questions: 1) Would I fund this business if I weren’t the founder? 2) Do I have proof (not hope) that someone needs this, will pay for it, and can’t easily switch away?

If you can answer both confidently, you’re ahead of most. And you might just get that term sheet. But only if you do the work.